real estate tax shelter example

It is the financial value of a residential property that the buyer of the home owns fully free and without any debt. Form 1099-G HomeownerRenter Data n Residential addresses for this year n Mortgage interest.

House Rental Contract Contract Template Rental Agreement Templates Lease Agreement Free Printable

25 to file your taxes.

. Many practices that fall within this definition are perfectly legitimate for example investing in real estate trusts and pension plans. These are cash losses. N State and local income tax refunds.

Investing in real estate is a common tax shelter. A tax shelter is an investment designed to dramatically lower the investors income taxes. Pick a state where youre taking your Real Estate Exam.

To see how a real estate tax shelter works lets go through an example using a 250000 property that generates 2000mo in revenue. It is a legal way for individuals to stash their money and avoid getting it taxed. Form 1098 n Sale of your home or other real estate.

One of the examples of tax-shelter can be seen in the case of Home equity. Tax shelters work by reducing your taxable income thereby reducing your taxes. However when a tax shelter is designed solely for tax avoidance it may be deemed inappropriate by the.

As an example lets assume that a property has a cash flow of 5000 in other words the cash income from the property exceeds cash expenditures by 5000 for the year. Real estate offers tax sheltering through depreciation operating expenses long-term capital gains and 1031 exchanges. In a real sense it means to buy certain goods that offer tax benefits.

A tax shelter is entirely different from a tax haven because the latter exists outside the country and its legality. A step-up in basis is another instrument that provides tax shelter although not directly to the initial investor. A tax shelter is a vehicle used by taxpayers to minimize or decrease their taxable incomes and therefore tax liabilities.

But first some backdrop-. To be a tax shelter the investment has to lose money. In other words you are having to put money into the investment to keep it.

Traditional tax shelters have included investments in real estate oil and gas equipment leasing and cattle feeding and breeding programs. The classic tax shelter which is hard to pull off nowadays without breaking the tax law is a piece of property that is subject to depreciation like real estate or heavy machineryThe investor pays for a small fraction of the property takes out a mortgage secured against the property to. When it comes to rentals it is easy to lose money especially if the rental income does not cover the mortgage you have several repair bills among other things.

These examples of tax shelters apply to real estate but there are others including tax-deferred retirement accounts 401ks and tax-sheltered annuities 403b. And real estate investments are. Find Forms for Your Industry in Minutes.

Streamlined Document Workflows for Any Industry. In addition to the deductions it allows you to make mortgage loan interest mortgage insurance and property taxes a real estate investment can help you grow wealth over time. Between 100000 and 150000 in income for married filing jointly couples the.

It is generally available to an employee to both reduce the amount of taxes paid on his income as well as to save for his future retirement. This is mainly due to its generous tax benefits. So the investor has 5000 spendable cash in his or her pocket.

Form 1099-INT and 1099-OID. Definition of Abusive tax shelter. In this article well take a look at how investors can calculate a baseline tax shelter on their real property assets.

The most common tax shelter is through such retirement accounts as a 401 k 401 b Roth IRA or a Roth 401 k. In 2022 employees can make up to 20500 in deductible contributions to a 401 k with workers age 50 and older entitled to deduct an additional 6500 in catch-up contributions. Other tax shelters include mutual funds municipal bonds.

Form 1099-S n Second mortgage interest paid n Real estate taxes paid n Moving expenses Financial Assets n Interest income statements. Ad State-specific Legal Forms Form Packages for Investing Services. The most widely used tax shelter in the United States is the 401 k employer sponsored plan.

The Internal Revenue Service IRS investment vehicles such as 401 ks and IRAs as legal tax avoidance mechanisms. Three Common Tax Shelters in Real Estate. A tax shelter is a method used by businesses and individuals to reduce their tax liabilities.

The numbers listed below are annual. A tax shelter is an investment or a business through which a taxpayer reduces his or her tax liability. A tax shelter is a financial vehicle that an individual can use to help them lower their tax obligation and thus keep more of their money.

Historically real estate has proved to be a significant tax shelter. Which holds true if one is willing to use deductions in tax shelter.

Free Purchase Agreement Form Free Printable Documents Real Estate Contract Real Estate Forms Real Estate

How To Decide If A Property Is A Good Investment The Washington Post

Property Flipping Tax Implications In Canada Cpa Firm In Toronto

Tax Deductions On Rental Property Income In Canada Pay Less Tax

Tax Deductions On Rental Property Income In Canada Young Thrifty

Real Estate Tax Invoice Template Google Docs Google Sheets Excel Word Template Net Invoice Template Estate Tax Google Sheets

What Is Estate Tax And Inheritance Tax In Canada

Tax Shelters For High W 2 Income Every Doctor Must Read This

How To Calculate Tax Payable On The Sale Of Your Rental Properties

Sample Printable Assignment Joint Ownership With Right Of Survivorship Form Real Estate Forms Legal Forms Free Lettering

Diy Or Hiring A Property Manager Which Is Better Property Management Real Estate Quotes Management

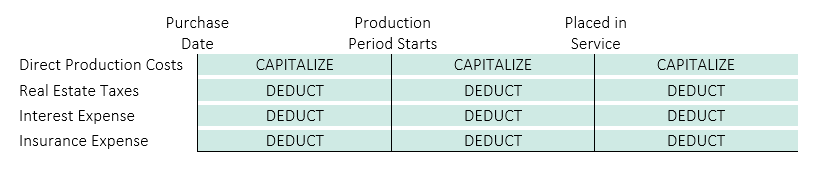

Real Estate Development When To Expense Vs Capitalize Costs Withum

Tax Shelters Definition Types Examples Of Tax Shelter

Top 6 Tax Benefits Of Real Estate Investing Rocket Mortgage

How To Avoid Capital Gains Tax On Real Estate Canada Ictsd Org

How Is A Tax Shelter Calculated In Real Estate

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2022 Propertycashin